long term care insurance washington state tax opt out

It is too late to Buy LTC insurance to avoid the Washington Long Term Care Tax. 800-891-5824 Long Term Care Blog.

Wa Cares Exemption How To Opt Out Of The Tax Brighton Jones

Call now for your free quote.

. You needed to apply earlier to have coverage in place by November 1 2021. If you still want to Plan. Employees now have until November 1 2021 to purchase long-term care insurance if they wish to opt out of the Washington State Long-Term Care Program.

Opting Out of The Washington State Long-Term Care Tax After an employees application for exemption is processed and approved he or she will receive an approval letter from ESD. But thats what Washington states 2019 long-term care law will do. Workers already approved for a permanent WA Cares exemption because they hold a long-term care insurance plan do not need to reapply.

Long-term care insurance companies have temporarily halted sales in Washington. 509 396-0588 888 474-6520 8905 W. Opting back in is not an option provided in current law.

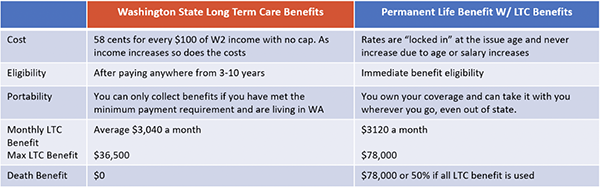

1 pay the tax 2 buy into a group long term care policy or 3 buy a qualifying policy that will allow you to opt out of the new tax. The Program which is codified at RCW chapter 50B04 will be funded by a 0058 058 percent payroll tax on all employee wages beginning January 1 2022. The website has been overwhelmed with visitors.

On October 1st the window to opt-out of Washington States Long-Term Care Tax opened. You must also currently reside in the State of Washington when you need care. The video below will walk you through the opt-out process.

Opting Out of The Washington State Long-Term Care Tax After an employees application for exemption is processed and approved he or she will receive an approval letter from ESD. The employee must provide this approval letter to his or her employer. Applying for an exemption.

It is too late. If you have purchased a private long-term care policy you should start the application process soon. 1 2023 exemptions granted to military spouses non-immigrant visa holders and those living outside Washington will not be permanent.

The Washington Cares Fund collects 58 cents for every 100 of income that workers in the state earn until they retire. LTC insurance typically covers the following types of services if theyre provided in a setting other than a hospitals. Turns out they were a bit premature.

Any employee who attests that they have comparable long-term care insurance purchased before November 1 2021 may apply to ESD for an exemption from the premium assessment. Why Opt Out of The Washington Long Term Care Tax. Employees have until November 1 2021 to buy long term care insurance to opt out of the program and to avoid the WA LTC Payroll Tax.

This is also true if you move to Washington state after the opt out window closes after 12312022 and you didnt already own long-term care insurance with a policy date. The employee must provide proof of their ESD exemption to their employer before the employer can waive. In this article we examine the pros and cons of each of these options and.

Up until the law was changed in March 2022 the only workers in Washington who were exempted from the program were those who owned long-term care insurance with an effective date prior to November 1st 2021. New State Employee Payroll Tax Law for Long-Term Care. Compare Best Long Term Care Insurance.

Individuals who have private long-term care insurance may opt-out. About 450000 Washingtonians purchased long-term care insurance before November 1st 2021 and opted out of the program. The employee must provide this approval letter to his or her employer.

The insurance companies will be re-entering the market after November 1. In that case the tax will be permanent and mandatory. The window to apply for an exemption occurs between October 1 st 2021 and December 31 st 2022.

Our Editorial Team Does Rigorous Research and Testing To Generate Accurate Content. 1 An employee tax for Washingtons new long-term care benefits starts in January. On the Create an Account page select the Create an Account button to the right of WA Cares Exemption.

Employers must maintain copies of any approval letters received. Keep in mind that once you opt. Employers must maintain copies of any approval letters received.

The Washington Long-Term Care Program is the nations first public state-operated long term care insurance program. To opt out you will need to purchase your own long-term care insurance policy as well as file a waiver application with the state between October 1 2021 and December 31 2022 for an exemption from the program. The Window to Opt-Out.

1 residents can apply to opt out of the WA Cares Fund a new long-term care insurance benefit for workers in Washington state. Due to the recent delay significant changes could be coming to Washingtons long-term. But if you want to opt out you may have some.

Ad Make the Right Choice With Our Help. Time is Running Out. Lets assume for the moment that you dont opt-out of the Washington long-term care tax program before the December 31 2022 deadline.

Opt-out option for Washingtons long-term care tax begins Oct. When we discussed What You Need To Know About Washingtons New Long Term Care Tax we mentioned three basic options available to Washington employees. Long-term care LTC insurance according to Washington state law legwagov is an insurance policy contract or rider that provides coverage for at least 12 consecutive months to an insured person if they experience a debilitating prolonged illness or disability.

After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program. We suggest you visit it during off-hours early morning late evening or the weekend. Once youve logged in and selected Paid Family and Medical Leave from your list of services in SAW youll click Continue to proceed to creating your WA Cares Exemption account.

You have one opportunity to opt out of the program by having a long-term care insurance policy in place by November 1 st 2021.

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

State Ltci Tax Incentives Got Ltci

What To Know Washington State S Long Term Care Insurance

The Washington State Long Term Care Trust Act Opt Out Is Now Available Online Parker Smith Feek Business Insurance Employee Benefits Surety

10 Questions To Ask Before Buying Long Term Care Insurance

Long Term Care Enrollment Deadline Extended To Oct 14 Afscme Council 28 Wfse

Washington State Delays Payroll Deductions For The Long Term Care Act Wa Cares Fund To 2023 Sequoia

Does Whole Life Insurance Make Sense In This Situation Wa Long Term Care Act R Personalfinance

What To Know Washington State S Long Term Care Insurance

Washington State Long Term Care Program Tax Premium Should I Get A Personal Ltc Policy To Opt Out 27yo May Not Get Another Change To Opt Out R Personalfinance

Washington State Trust Act Should You Opt Out Buddyins

Where Long Term Care Reform Goes Now

Washington S Long Term Care Program Wa Cares Survives Another Challenge The Seattle Times

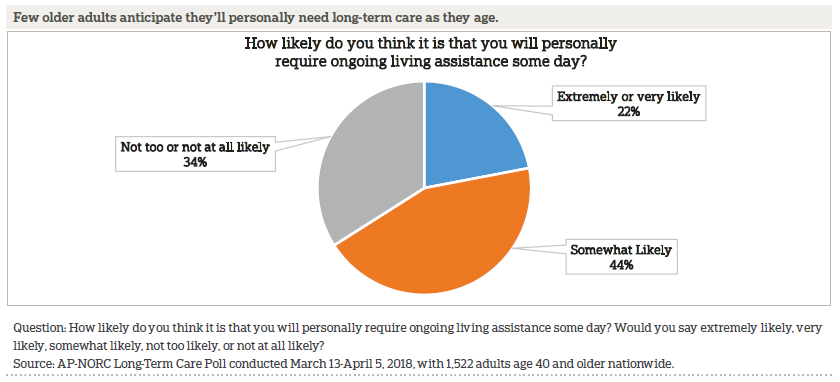

Long Term Care In America Increasing Access To Care The Long Term Care Poll

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Washington State Delays Public Long Term Care Insurance Until April Explores Changes

Analyst S Advice For Washingtonians Who Got Private Long Term Care Insurance Mynorthwest Com

What To Know Washington State S Long Term Care Insurance

Washington State S New Payroll Tax Ignore At Your Own Peril Joslin Capital Advisors